How to get the municipal capital gain to pay in Teulada-Moraira

The municipal capital gain is a tax that must be paid for the capital gain generated in a property over time, that is, it taxes the increase in the value of land or properties. In the case of Moraira, this tax is administered by the City Council and is a way for owners to contribute to the financing of public services and the improvement of the quality of life in the city. In our Moraira Estate Agents we accompany our clients in all phases of the sale, from the search phase (when it is a purchase) to the final phase of tax management, and final procedures.

Factors to take into account to calculate the municipal capital gain

To calculate the municipal capital gain in Moraira, the following factors must be taken into account:

-

Cadastral value: The cadastral value is an estimated value that is assigned to a property by the government. This value is used as the basis for calculating the municipal capital gain. To know the cadastral value of a property in Moraira, it is possible to consult the Property Registry or the Town Hall.

-

Age of the property: The age of the property also influences the calculation of the municipal capital gain. Generally, the older the property, the less surplus value it is considered to have generated.

-

Market value: The market value of the property is also important when calculating municipal capital gains. This value represents what could be obtained for the property in the current market and is a way to determine whether the equity has increased or decreased over time.

-

Percentage of the surplus value: The percentage of the capital gain that must be paid as a tax depends on the laws and regulations in force in Moraira. It is important to know this percentage in order to properly calculate the municipal capital gain.

It is important to bear in mind that the calculation of the municipal capital gain can be complex and that it is advisable to have the help of a professional if you have difficulties to do it.

How the municipal capital gain is calculated

By Royal Decree 26/2021 of November 8, there are now two different ways to calculate the Tax Base of the rate to be paid, existing the objective method and the method of real capital gain.

- The objective formula: In the case of objective formula calculation, the cadastral value is multiplied with new coefficients (modifiable each year depending on the real estate market). This method is optional, since the taxpayer has the possibility of taxing according to the real capital gain obtained at the time of the transfer of ownership. In this case, the cadastral value of the property will be multiplied with new coefficients.

- The real formula: This form will be a calculation of the difference between the sale or transfer price and the purchase or acquisition price of the property. If the taxpayer can demonstrate that the real capital gain is lower than that resulting from the objective estimation method, the calculation of the real formula may be applied.

Objective method of municipal capital gains

-

Calculate the tax base

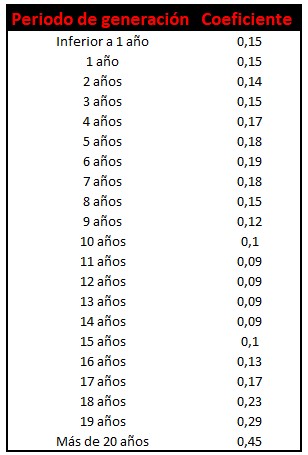

According to the Royal Decree previously named, it is established that the taxable base of the tax is the result of multiplying the cadastral value of the land at the time of accrual by the coefficients that exist marked in each municipality. Let's see the current periods for the municipality of Teulada-Moraira:

-

Apply the tax rate

The second step is to apply the tax rate on the tax base. This tax rate is established by the City Council of Teulada-Moraira and right now it is 30%.

Real surplus value method

As we have seen above, the municipal capital gain calculated with the Real method takes into account the Capital Gain obtained by the sale of the property without taking into account the number of years. The following steps are followed in this case:

- Calculate the municipal profit: For them, the value of the property on the day it was purchased will be subtracted from the value of the transmission.

- Multiply by the % that represents the cadastral value: Once the municipal profit is obtained, it is multiplied by the percentage that represents the cadastral value of the land on the total cadastral value of the property. In this way the Tax Base is drawn.

- The Tax Rate is applied: Once we have obtained the Tax Base we apply the corresponding Tax Rate according to the town hall, in this case the City Council of Teulada-Moraira.

Calculating the capital gain is not always easy, so we always recommend that you be accompanied by good professionals in the sector when carrying out important purchase and sale operations for you.